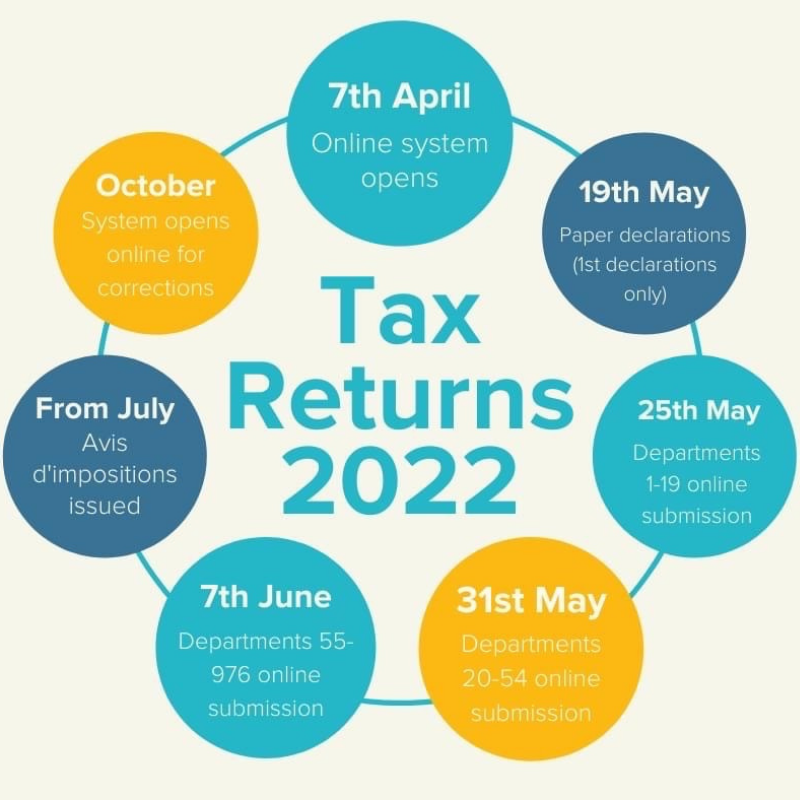

7th April, French online tax system opens today!

Today is an important day in the French tax calendar as the online systems open their doors, the paper declarations open on 19th May. The “Avis d’Impositions” are issued from July onwards. If you are a non-resident then the French Government have a handy summary of the property taxes you will be liable to pay. The page (and FAQ’s) are in English and you can access them here. Meanwhile, if you are thinking of selling your property in France then a) you should be talking to our sister company, Leggett Immobilier and b) here’s a very broad-brush guide to Capital Gains Tax:

French Capital Gains Tax

Capital Gains Tax (CGT) is payable on any profits you make on the sale or transfer of real estate in France. This article focuses on how it affects UK residents, with holiday homes here.

Capital Gains Tax (CGT) is known as Plus-Value in French, it is subject to both income tax and social charges. This post focuses on how it applies to a holiday home. You should always take professional advice, this is a highly complicated area.

Will I pay CGT?

CGT and the associated social charges are payable on the sale of your second home in France if it has sold for a profit. There are some exemptions – there is no CGT payable if you have owned it for more than 22 years, and no social charges are payable if you have owned the property for more than 30 years. There is also no CGT on property sales of under 15,000 euros. Don’t forget, we are talking about second homes here, there is nothing to pay if you sell your principle residence. There are other exemptions and we highly recommend you speak with a specialist. LPM has a partnership with a bilingual French tax specialist, contact us for full details.

How much is CGT in France?

CGT has a flat rate of 19% and the social charges element has a flat rate of 17.2%, giving a total of 36.2%. Don’t forget though that there are allowances that could reduce your payments. On the CGT element of 19% if you have owned the property for 6-21 years there is a progressive allowance, and from 22 years there is 0% to pay. For the social charges element, if you are a UK resident you will pay 7.5%, not the full 17.2%. These social charges are also subject to a reduction over time, with a progressive allowance kicking in after six years. The good news is that there are deductions you can make from your gain (such as acquisition costs and renovation costs). The bad news is that there are supplementary taxes to be paid if the gain is over 50,000 euros.

- for a gain of between 50-100,000 euros you pay an extra 2%

- for a gain of between 100-150,000 euros you pay an extra 3%

- for a gain of between 150-200,000 euros you pay an extra 4%

- for a gain of between 200-250,000 euros you pay an extra 5%

- for a gain of above 250,000 euros you pay an extra 6%